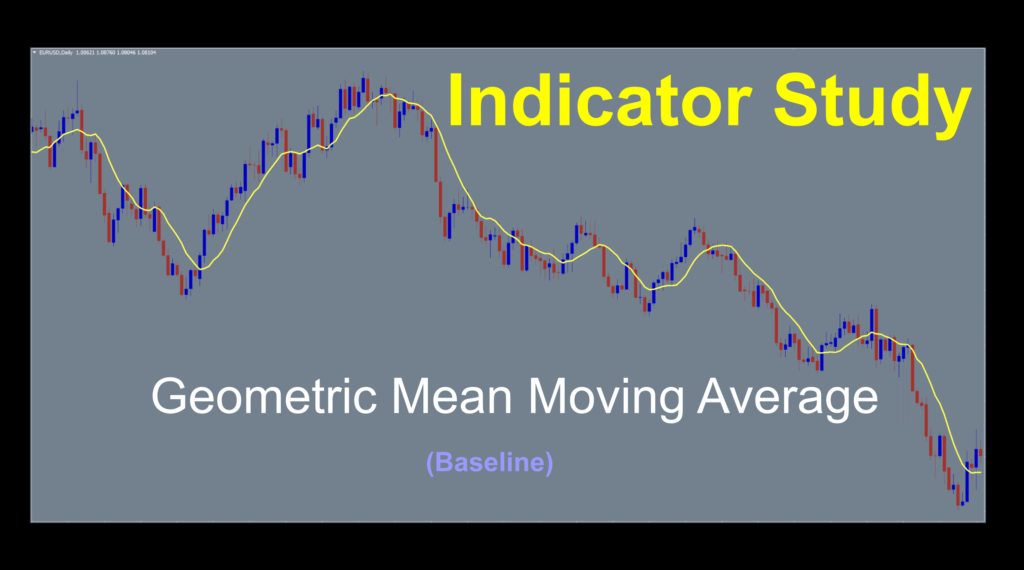

Geometric Mean Moving Average

If you’d like to follow along with the e-book version of the blog, click on the play button in the audio player below (at the bottom of the page).

Sounds Very Technical

The title of this week’s indicator has a very technical sounding name. Ironically, the math is not very complicated, although I’d be remiss to dismiss it as something easily (and repeatedly) calculated blistering fast when plotting the signal line. Once again, let’s all give a collective thanks to the tiny microprocessor, and the fact that we’re alive to use it to our advantage. After all, the alternative of working slide rule arithmetic would kind of suck.

Midweek Shenanigans

We’re recording our data stream mid-week, the same week as last week’s confirmation indicator. We’re not breaking any rules, right? That being the case, we recorded two sessions of the indicator; one with standard settings and a shorter clip with altered settings to help novice traders learn how baselines work. After all, mixing things up for diversity keeps things interesting in what should really be a boring endeavor.

Boring Endeavor?

Forex trading is boring? What sacrilege is he speaking of? Fair question. We occasionally plug some trading psychology into the indicator series, and this seemed like a good time to bring up a little something. Let me repeat.

Forex Trading Should be Boring

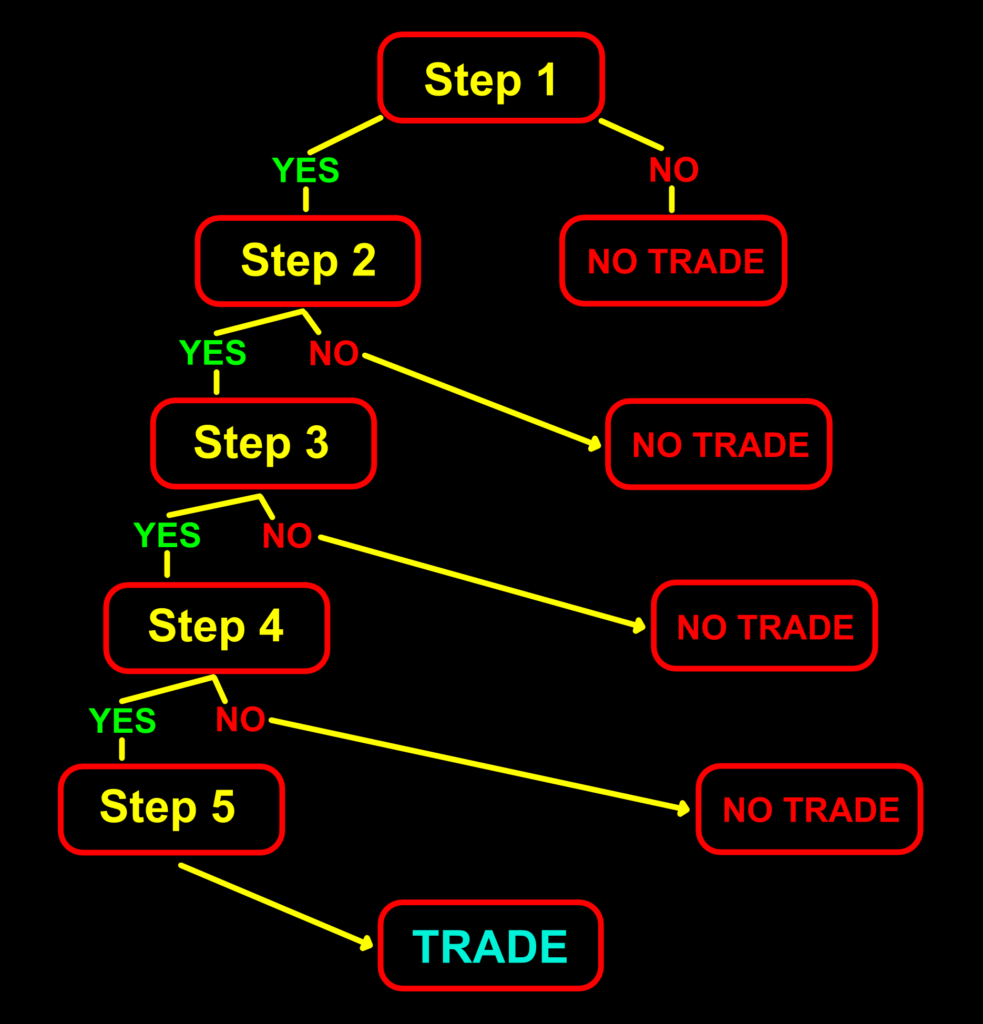

Let me clarify that statement. Algorithmic trading is a series of decisions that follow something called “Boolean Logic”. If something happens (or doesn’t), then something else happens (or doesn’t). Simple binary decisions – yes/no, true/false using three operators; AND, OR, and NOT. It sounds a little odd, but just think of a decision tree.

That’s an algorithm, or a process with specific rules for problem-solving operations. Substitute the parts of your algorithm into those little red boxes and voilà, you have your logic statements for making trades. I don’t see any emotions lurking in those boxes, do you? This week’s video is a little longer because we’re spending a few moments on something significant. We’ll keep it light and breezy, but you don’t want to miss it.

You’re So Kind

We’re getting indicators each week, and we appreciate it. Some contributors even check for repainting, which is a nice bonus as we’re finding many we test are, in fact, repainting indicators. As we mentioned in the digest, we are collecting them to create an ongoing blog as a kind of public service announcement. In the meantime, keep sending your findings for the indicator profile series. VP and I examine each one. The email address is [email protected], and as always, thanks for your efforts.

Lifestyles of the Geometric Crowd

This week, we’re looking at a baseline called Geometric Mean Moving Average. The indicator was coded in 2012 at the request of a trader who wanted to use the geometric mean calculation of price as a signal line for trend identification. Cool idea. We actually have the equation for the slide ruler gang.

GMA = [P1 x P2 x P3 …x Pn]1/n

Where:

P1, P2, … Pn = price data for each period

n = the number of periods

An Older Version of the Matrix

The geometric mean calculation is nothing new. In fact, it’s quite archaic. One of the greats discovered it. You may know his name. Hint…he’s Greek. Get it yet? If not, this brainiac is none other than the ancient Greek philosopher Pythagoras. Remember the Pythagorean Theorem from high school trigonometry? Same guy.

What’s the difference

What is the difference between a regular moving average and a geometric mean moving average? Glad you asked. A regular moving average adds data, where the geometric mean moving average multiplies data. This gives a much quicker reacting moving average for quicker trend identification.

Changes in Attitude

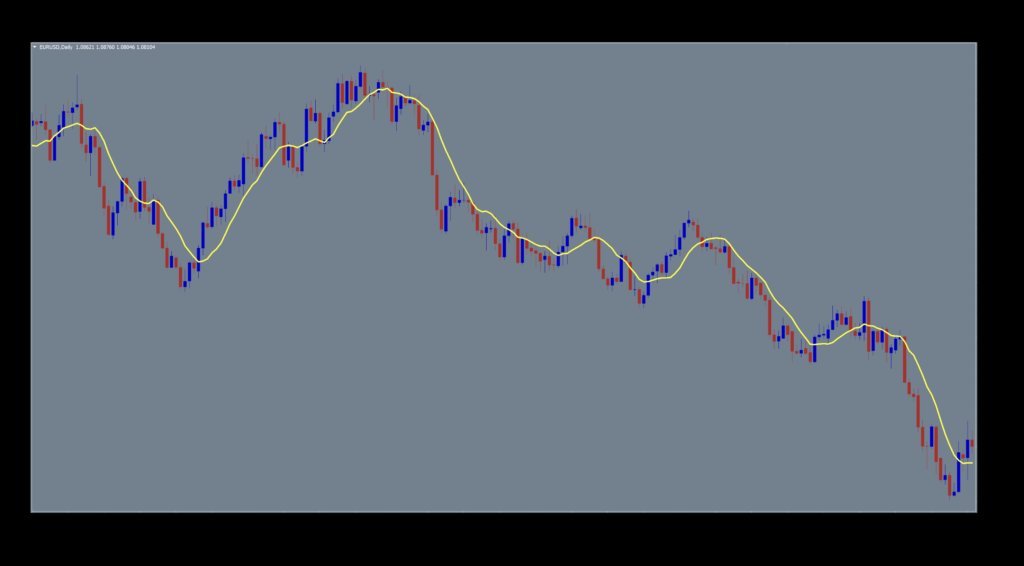

The visuals for this look a little different from our usual display. We changed the background from black to gray, changed the signal line to a thicker yellow, and made our candles darker shades of blue and red to assist with trade entry signal identification.

Settings

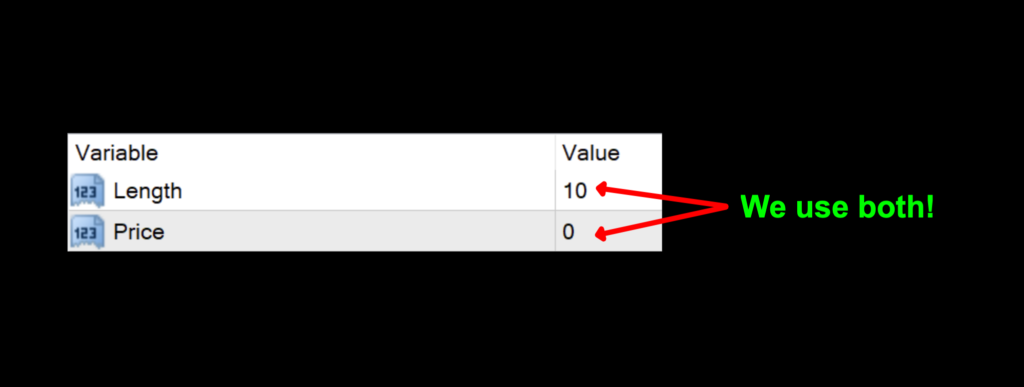

There are only two settings for this indicator, and we use both.

Length: This value determines the number of periods used for the overall calculations. The default value is 10.

Price: The data set used by the price data in the moving average calculation where 0 – Close, 1 – Open, 2 – High, 3 – Low, 4 – Median, 5 – Typical, and 6 – Weighted. The default value is 0 – Close.

Advantages

* We love moving averages. They’re usually one of the first indicators we learn as novice traders.

* Easy to test, only two settings.

* Reacts quickly to change in price.

How we use it.

We want to clarify something specific to the NNFX system. There are three possible trade actions;

OPENING A TRADE

CLOSING A TRADE

MAINTAINING A TRADE

One of these three actions need to happen in the last 30 minutes prior to the close. This is when you make your trading decisions, and not actually wait for the close at 1700 EST, because we trade on the daily time frame.

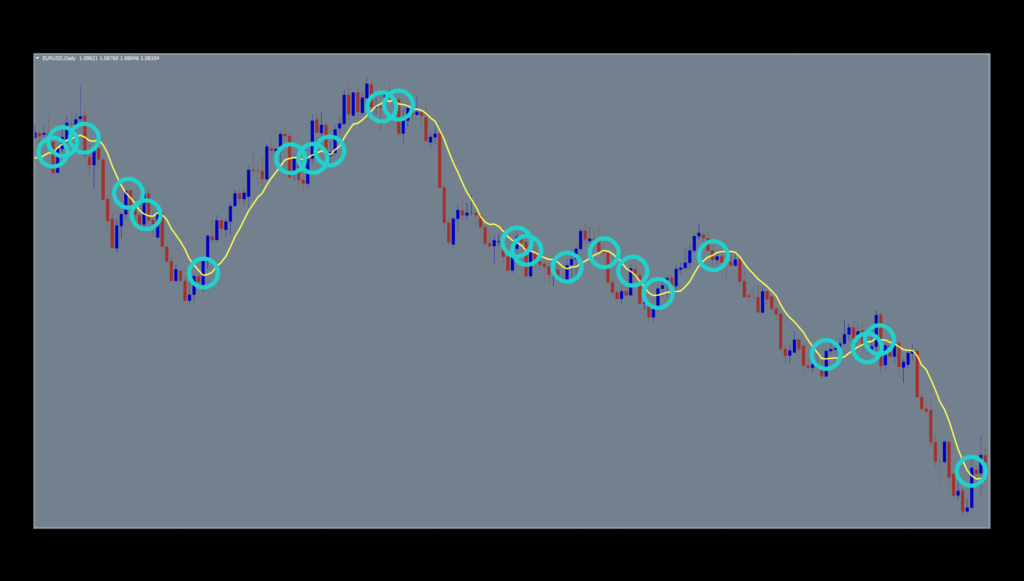

Long signal: When price crosses above the signal line. Entry is in the last 30 minutes of the trading day.

Short signal: When price crosses below the signal line. Entry is in the last 30 minutes of the trading day.

Mind the Circles

We stayed with the default settings, as usual. One thing that really stands out is how many signals are generated when price lacks significant volatility and flattens. This is where your algorithm would filter out some of the false signals, preventing losses. And we all know that reducing losses can be better than winning.

Testing Going On Here

If you’re new to these studies, we recommend looking at some of the older blogs to understand how we conduct our testing.

The six pairs we recommend testing are…

EUR/USD

AUD/NZD

EUR/GBP

AUD/CAD

CHF/JPY

CAD/SGD

The markets we test our indicators are the:

EUR/USD (Euro/US Dollar)

BTC/USD (Bitcoin/US Dollar)

XAU/USD (Gold/US Dollar)

SPX500 (S&P500 Index)

Timeframes and Results

We’ll run the Geometric Mean Moving Average indicator on the EUR/USD, BTC/USD, XAU/USD, and the SPX500 using the default and tweaked settings across the daily and 4-hour timeframes on the MT4 strategy tester.

We focus on three metrics;

Total trades

Win/Loss ratio

ROI (return on investment)

Results For Your Review

Below are the results from our testing endeavors.

Elevated Occurrences

The first thing we noticed is how many signals were given on the default settings, save the 4-hour BTC. This really wasn’t a surprise, considering that the indicator naturally reacts quickly to price action. In every circumstance, we had to “slow” down the indicator’s math to get better results. Unfortunately, for 4-hour gold, there were no combinations using our criteria during the testing period which resulted in a positive return. That’s fine, we move on.